7 Actions Enterprise Architecture Leaders Must Take to Navigate Economic Headwinds

A turbulent economy requires smarter technology investment decisions, which means accelerating use of digital technologies, managing spend and leveraging talent. Enterprise architecture leaders can help by taking our seven proven actions to respond to economic headwinds.

Overview

Key Findings

- We live in volatile, uncertain, complex and ambiguous times. This forces C-suites and boards of directors to develop economic scenarios and business strategies to counter economic headwinds.

- Organizations are committed to accelerating digital technology investments, but CEOs want to see top-line and bottom-line benefits of digital investments that counter economic turbulence.

- Although corporate hiring is slowing, many organizations still struggle to hire the critical digital talent they need to accelerate the time to value of key digital initiatives.

Recommendations

To navigate economic headwinds, enterprise architecture (EA) leaders must help business and IT leaders:

- Accelerate digital business by enhancing customer and employee experience, investing in AI and autonomous digital initiatives, and creating outcome-driven metrics.

- Manage spend by facilitating technology trade-off decisions, while accelerating migration to the cloud and challenging existing processes to make the organization faster, simpler and more agile.

- Leverage talent by rethinking work models and practices to enhance how the EA practice supports democratized digital delivery and drives business outcomes.

Strategic Planning Assumption

- By 2027, 50% of extra-large organizations will use business architecture to advance strategic planning in the face of volatility, uncertainty, complexity and ambiguity.

Introduction

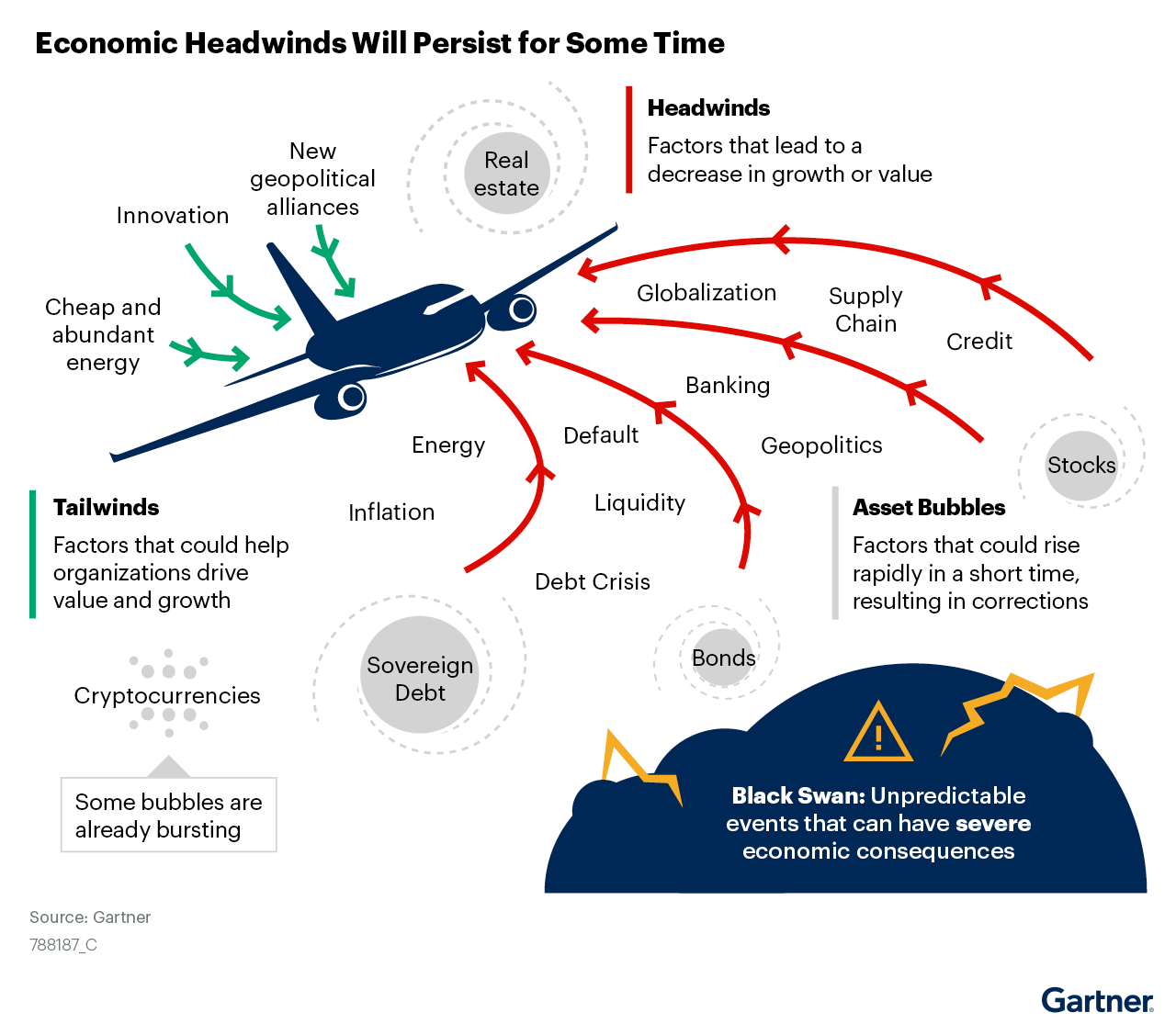

We live in volatile, uncertain, complex and ambiguous (VUCA) times.1,2,3 Sticky inflation, rising interest rates, a potential banking crisis, geopolitics, the invasion of Ukraine, climate change, trade wars and the political polarization of society are sources of increasing risk to organizations worldwide (see Figure 1).

The conflation of economic headwinds is likely to persist for some time, forcing C-suites to develop economic scenarios and business strategies to remain competitive. However, predicting which scenario will occur and exactly where organizations will “land” is anyone’s guess. Organizational leaders are likely to be grappling with one, if not more, of the following economic scenarios (see Note 1):

- Roaring back to growth

- Stuck in time and great stagflation

- Soft landing and slow repriming of the pump

- Financial crisis

While business leaders are contending with economic uncertainty, many enterprise architecture leaders don’t know where to focus their time and attention to help their organizations prepare for, or respond to, a turbulent economy.

EA leaders play a vital role in helping their organizations close the strategy-to-execution gap. They are essential to helping business and IT leaders make smarter, better and faster technology investment decisions. They must help enable business model transformation and innovation investments in operating models, and the underlying technologies that enable them, at a faster pace. To do this successfully, EA leaders must focus on resilience and adaptiveness.

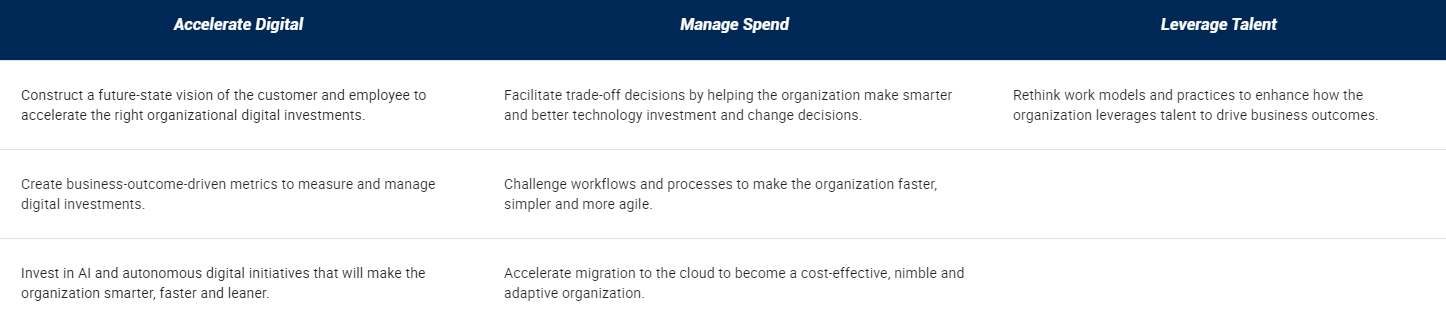

In this research, we identify seven actions EA leaders must take to help their organizations navigate economic headwinds. We discuss how EA leaders can perform those actions while aligning them with the top three overarching mission-critical priorities of the C-suite.

- Accelerate digital

- Manage spend

- Leverage talent

Table 1: Seven Actions EA Leaders Must Take to Help Their Organization Navigate Economic Headwinds

Analysis

Accelerate Digital

Accelerating digital entails making plans to implement the latest digital technologies to create new business and operating models, improve organizational processes, and enhance interactions between people, organizations, assets and things. EA leaders can help select and prioritize the right digital investments.

Action 1: Construct a future-state vision of the customer and employee to accelerate the right organizational digital investments.

The Challenge

As digital channels are increasingly the main vehicles for engagement, business leaders must identify and make the right digital investment decisions to simultaneously improve both customer experience (CX) and employee experience (EX).5 Without investment in CX and EX technologies, organizations will fail to retain customers and scarce talent, as well as to improve organizational efficiency and employee productivity.6

How Enterprise Architects Can Help

Lead with business architecture:Identify business and application opportunities that will improve the flow of value to customers and the employees who support them. Use business architecture activities to enable the CX and EX fusion teams to link IT efforts to business direction and strategy, close the strategy-to-execution gap, and design and implement a prioritized outcome-driven digital investment roadmap.

Put the customer at the center of the analysis: Identify who the customer is and put the customer at the center of the analysis. Use a design thinking methodology and deliverables such as customer journey maps and service blueprints to define the services and experiences that meet customer needs.

Design the EX: Match the CX with EX. Follow a similar methodology and approach to design CX, but put the employee at the center of the analysis.

Identify change requirements and construct roadmaps: Use the future-state CX and EX design to determine what needs to change across people, process, technology and information to implement the design. Work with CX and EX fusion teams as well as the project management office, if there is one, to develop the roadmaps, project portfolios and product backlogs to execute CX and EX initiatives.

Create the investment plan: Use change requirements, roadmaps, and the project portfolio and product backlog to determine what CX and EX capabilities must be built and when. Also determine the scope and scale of investment needed to close the CX and EX strategy-to-execution gap.

Related Research

Tool: Business Architecture Activities and Deliverables Close the Strategy-to-Execution Gap

Top Strategic Technology Trends for 2022: Total Experience

Achieve Best-in-Class CX Wins Through Total Experience

Tool: Total Experience Scoping Guide

Total Experience Transformation Starts With Business Architecture — Presentation Materials

Action 2: Invest in AI and autonomous digital initiatives that will make the organization smarter, faster and leaner.

The Challenge

Organizations stand to greatly benefit by investing in AI and autonomic systems.7 However, the C-suite and business executives must consider and navigate many challenges to make this happen.8,9 These challenges include a lack of understanding of this complex technology and keeping abreast of the rapid pace of innovation. They also include intellectual property rights, data privacy and security concerns, algorithmic bias, digital ethics and their impact on humans, and understanding the competitive and crowded marketplace.

How Enterprise Architects Can Help

Identify AI and autonomic systems opportunities: Identify business opportunities where AI and autonomic systems can help the organization create new business and operating models and streamline operations. Ensure the targeted business outcomes for AI and autonomic systems map to the organization’s business capabilities and, in turn, map to the organization’s investments in AI and autonomic systems. Evaluate the organization’s processes and identify areas where AI and autonomic systems can automate and streamline processes (automate repetitive tasks, analyze data to identify patterns and trends, and enable predictive analytics). Focus enterprise investment in AI and autonomic systems on the areas most likely to deliver the highest net present value (NPV) and ROI.

Work with stakeholders to formulate AI and autonomic strategy: Work with a broad group of enterprise stakeholders to formulate the enterprise AI and autonomic strategy. Form an enterprise AI and autonomic cloud strategy council with members from diverse teams and perspectives so that AI and autonomic strategy is not viewed as an IT issue developed in a vacuum. Establish an AI and autonomic center of excellence as an IT-only function. Ensure the EA practice creates and leads the council. Use the AI and autonomic strategy council to:

- Clarify the strategic intentions of AI and autonomic systems

- Identify AI and autonomic business outcomes

- Explore the implications, impacts and risks of AI and autonomic systems

- Address stakeholder questions on AI and autonomic systems

Select the right AI and autonomic tools: Recommend the right AI and autonomic tools and technologies that enable current and future-state business capabilities and those best suited for opportunities that grow revenue, optimize cost and mitigate risk. Work with vendor management and procurement teams to support the selection process.

Integrate AI into the broader IT estate: Use the AI and autonomic strategy as the foundation for constructing AI and autonomic implementation plans. Align AI and autonomic strategies with other strategies surrounding composable digital foundations and platforms. Work with other IT disciplines through project and fusion teams to integrate AI and autonomic systems into the organization’s existing and future systems and infrastructure, both on-premises and in the cloud. Recommend changes that will enable the successful integration of AI and autonomic technology with the organization’s data architecture.

Identify skills and capabilities to invest in, and manage, AI and autonomic systems: Help the organization identify and build the talent, skills and capabilities (such as data science, machine learning and software engineering) required to implement and manage AI and autonomic systems. Help develop a talent management plan, including a training and development plan to ensure the organization has the necessary skill sets and expertise.

Establish an AI and autonomic systems governance and assurance framework: Ensure the benefits of AI and autonomic systems outweigh the associated risks and societal costs. Create a governance and assurance framework before investing in AI and autonomic systems. Include AI and autonomic systems strategy, vendor selection criteria, data classification and protection policies, access control and identity management as part of governance. Ensure compliance with regulatory requirements. Institute controls and standards to ensure the organization’s AI and autonomic objectives are realized.

Measure the success of AI and Autonomic Investments: Develop metrics to measure (accuracy, speed, efficiency, patterns, trends and cost saving) the success of AI and autonomic systems initiatives and investments. Measure the success of AI and autonomic investments to understand tier impact and make informed decisions about future AI and autonomic investments. Create dashboards and reporting to provide real-time visibility into the organization’s AI initiatives’ performance.

Related Research

4 Top Practices That Help EA/TI Leaders Add Value to Artificial Intelligence Initiatives

What Is Artificial Intelligence? Ignore the Hype; Here’s Where to Start

Hype Cycle for Artificial Intelligence, 2022

Building a Digital Future: Autonomic Business Operations

Applying AI — A Framework for the Enterprise

Action 3: Create business-outcome-driven metrics to measure and manage digital investments.

The Challenge

Transparency and accountability are vital to accelerate the delivery of digital benefits. Most organizations do not create visible, explicit digital metrics. The lack of connection between business outcomes, business-outcome-driven metrics, technology-outcome-driven metrics and technology operational metrics enables some business leaders to evade responsibility for poor results. This impacts financial performance.10,11

How Enterprise Architects Can Help

Create outcome-driven metrics: Help business and IT leaders create outcome-driven metrics to measure operational and business outcomes. These must link to the business outcomes on which business and IT leaders depend, and to the outcomes that are dependent on them. Use outcome-driven metrics to measure and report on the outcomes of digital investments, create situational awareness to manage operational risk and measure the readiness of technology to support business outcomes. Utilize outcome-driven metrics to facilitate informed conversations with business executives to influence priorities and digital investments.

Identify business leaders with accountability for a functional area: Work with business leaders to prioritize digital investments that focus on financial impact and driving business outcomes. Speak with functional business leaders to understand what aspects of digital investment must be measured and how. Identify all the other contributing initiatives underway that will collectively deliver the desired business outcomes and financial impact of the digital investment. Ensure contributing initiatives target improvements to key activities in the value chain such as leading indicators of progress toward the shared goal.

Construct a metrics hierarchy: Create outcome-driven metric hierarchies to connect technology operational metrics to technology-outcome-driven metrics to business-outcome-driven metrics and to business outcomes. Use the metrics hierarchy to visually depict the dependencies across digital investment initiatives that historically have been run as independent, siloed efforts. Facilitate the integration of siloed efforts by creating a metrics hierarchy template (deliverable) that reflects the hierarchy of business and technical outcome metrics for the related initiatives that collectively deliver the digital investment.

Reconcile metrics across multiple business leaders: Guide discussions among business leaders using a value stream mapping approach. Show how top-level business outcomes are achieved and who is responsible for each activity within the value stream. Show how digital investment initiatives are linked to business efforts and how the initiatives collectively impact profitability. Limit the number of metrics for measuring digital initiatives and monitor their progress to ensure business leaders focus on the few that align IT with targeted outcomes.

Related Research

Defining Metrics to Track the Success of Your Strategy

OKRs, KPIs and ODMs: How They’re Different and When to Use Them

How Enterprise Architects Use OKRs to Deliver Business Outcomes

Ignition Guide to Creating a Functional Health Dashboard for the Head of EA

Digital Execution Scorecard

Manage Spend

Spend management means maximizing value from company spend while decreasing costs. It is a set of practices that ensures organizations make spending decisions in the interests of the bottom line and company efficiency. EA leaders can help maximize value from company spending.

Action 4: Facilitate trade-off decisions by helping the organization make smarter and better technology investment and change decisions.

The Challenge

Since 2018, CEOs have increased investments in digitalization of their businesses and in information technologies.12 With a challenging economy, CEO and boards of directors now want to see top-line and bottom-line benefits of digital investments that counter economic headwinds.13 They expect their CIOs to orchestrate initiatives across the enterprise that collectively deliver “digital dividends.” Beyond the indirect benefits realized to date, they expect improvements in the enterprise financials driven by digital technologies. This requires a prioritized list of resource trade-offs in cost management and budgeting.

How Enterprise Architects Can Help

Ask the right questions to prompt trade-off decision making: Ask questions about potential digital initiatives that support the kind of financial impact with which the organization wants to counter economic headwinds. Identify the type of financial impact that the CEO, CFO and CIO want, and prioritize digital initiatives that support it. Ask how does this initiative support our cost reduction targets? How will this initiative support our customer retention goals? By how much? Does this meet our economic value added, return on investment, return on assets and other financial performance metrics?

Use business architecture to make technology investment trade-off decisions: Use business architecture activities and a combination of business architecture deliverables to articulate and guide technology-enabled investment decision making so that the organization can realize its strategy. Provide guidance that aligns project and product investments with enterprise goals, objectives and outcomes. Identify business opportunities and corresponding applications in the applications and product portfolio that will improve the flow of value to customers and the employees who support them. Use business architecture deliverables as input and a catalyst to help product managers and agile teams pinpoint and speed delivery. Develop roadmaps that reflect investments in, and changes to, the underlying IT estate.

Collaborate with stakeholders to prioritize the right digital initiatives: Work with business leaders to prioritize new and in-progress initiatives based on their potential impact to the top and bottom lines. Ensure new and in-progress initiatives have adequate resources. Recommend the organization pause or stop initiatives with less impact. Make sure that, in a tight economy, the selected digital investments yield benefits more quickly. Develop a narrative that explains your thinking and that you can communicate to stakeholders to build buy-in.

Use different financial techniques to make trade-off decisions: Make informed decisions about digital investments by working with the finance department to compare investment options and determine which is the most financially viable. Use different financial techniques such as ROI, NPV, internal rate of return and payback period. Use cost-benefit analysis to quantify the costs and benefits of each and compare them to determine which provides the greatest net benefit. Use scenario planning to consider opposing concepts that map to different decision-making strategies and explore the impact of these potentially different worlds. Use balanced scorecards to measure and track the impact of digital investments. Use sensitivity analysis to evaluate the impact of changes in different variables on the financial viability of a digital investment.

Identity the trade-offs and make the investment decision: Consider the merits of different business cases and use trade-off analysis in the decision making process to evaluate the benefits and costs of different digital options. Assess the relative strengths and weaknesses of each option. Determine which ones provide the greatest value against criteria, such as choosing a CX/EX investment that is more expensive, but increases customer interactions and satisfaction, and drives revenue and profitability. Facilitate continuous reprioritization of digital investments to respond to, and counteract, changing economic conditions.

Related Research

Tool: Business Architecture Activities and Deliverables Close the Strategy-to-Execution Gap

Tool: Investment Evaluation Criteria Selection Tool

Beyond NPV: Improve Investment Returns by Identifying Business-Case Assumptions

Effective Use of Financial Metrics in Standard Business Investment Evaluation

Case Study: Resource Intensity Investment Criteria (ReadyFund*)

Action 5: Accelerate migration to the cloud to become a cost-effective, nimble and adaptive organization.

The Challenge

Cloud migration involves moving applications, data and other resources from on-premises infrastructure to cloud-based infrastructure. Migrating to the cloud brings many benefits, including increased flexibility, scalability and cost savings. But it also brings many challenges, including complexity, concentration risk, security, performance and cost. Without an enterprise cloud strategy, organizations are unlikely to achieve their targeted business and technology outcomes.14 An IT push for a cloud-first strategy without business buy-in and mandate is likely to fail.15

How Enterprise Architects Can Help

Develop an enterprise cloud strategy: Maximize the benefits from using the cloud by helping business executives create a cloud strategy that enables digital transformation and optimization initiatives. Ensure the targeted business outcomes for using the cloud map to the organization’s business capabilities, and, in turn, to the organization’s investments in the cloud. Use the cloud strategy as the foundation for constructing implementation plans.

Determine and prioritize what can be migrated to the cloud: Use business architecture and application portfolio management to assess the organization’s IT estate and environment. Analyze the organization’s systems, applications and infrastructure to determine which resources can be moved to the cloud and which must remain on-premises. Focus on resources where there is a backlog of legacy and technical debt. Use the assessment to identify challenges and risks that may arise during the migration process.

Prepare a cost-benefit analysis: Determine whether cloud computing is the right choice for the organization by ensuring the benefits outweigh the costs. Identify the potential capital expenditure versus operating expenditure benefits of investing in the cloud. Consider the benefits of scalability. Scalability enables the organization to quickly and easily add or remove resources. This helps eliminate overprovisioning, which can be costly and wasteful. Also assess the benefits of disaster recovery, including backup of data replication that can help businesses recover quickly. Estimate the costs associated with migrating to the cloud. Consider the cost of migrating existing data and applications. Also consider subscription fees, the cost of training employees to use new cloud-based solutions, ongoing support costs and the additional security measures needed to secure data.

Select cloud service providers: Help the organization (security, HR, finance, legal, risk management, IT operations and development) select the right cloud service providers. Consider criteria such as providers’ size, reliability, security, scalability and cost-effectiveness. Assess the compatibility of the cloud service with the organization’s existing systems and applications.

Establish a cloud migration governance and assurance framework: Ensure the benefits of migrating to the cloud outweigh the associated risks. Create a governance and assurance framework before migrating to the cloud. Include cloud strategy, cloud service provider selection criteria, data classification and protection policies, access control and identity management as part of cloud governance. Ensure compliance with regulatory requirements such as the General Data Protection Regulation, the Health Insurance Portability and Accountability Act and the Payment Card Industry Data Security Standard. Institute controls and standards to ensure the organization’s cloud governance objectives are realized.

Design the cloud infrastructure: Design the target-state infrastructure that will be used to support the organization’s systems and applications, now and in the future. Create a secure network architecture, design storage solutions, and determine the best cloud deployment model for each application and an exit strategy.

Assign EA talent to support cloud migration fusion teams: Determine what types of domain architects (business, information, solution, product, applications, infrastructure, security) will be required to support fusion teams that migrate resources to the cloud with minimal disruption to daily operations. Roll different domain architects on and off cloud migration initiatives as needed to solve real-time problems in the workload-by-workload cycle.

Optimize cloud infrastructure: Ensure the organization’s systems and applications are fully optimized for the cloud. Design systems and applications to take advantage of cloud-native features and capabilities such as autoscaling and fault tolerance. Ensure the organization’s data is migrated to the cloud securely and efficiently. Monitor the organization’s infrastructure to make sure it is secure, reliable and cost-effective.

Related Research

The Cloud Strategy Cookbook, 2023

Quick Answer: What’s the Difference Between a Cloud Strategy and a Cloud Adoption Plan?

Approaches to Avoid Common Cloud Strategy Pitfalls

Align Your Cloud Strategy With the Organizational Strategic Plans

5 Actions to Manage Cloud Concentration Risk

Action 6: Challenge workflows and processes to make the organization faster, simpler and more agile.

The Challenge

With a turbulent economy, CEOs and boards of directors want to see the top-line and bottom-line benefits of digital investments that counter economic headwinds.16, 17 To remain competitive and drive profitability, organizations must grow revenue, reduce costs, increase productivity and efficiency, expand into new markets, and develop new products and services. This requires organizations to continuously revamp their workflows and processes to make them faster, simpler and more agile.

How Enterprise Architects Can Help

Lead with business architecture: Work closely with business process owners to understand their targeted business outcomes and future-state business capabilities. Analyze existing business processes and identify silos, gaps, bottlenecks and inefficiencies. Recommend business process improvements to streamline operations and eliminate inefficiencies by constructing and using key business architecture deliverables.

Align workflows and processes with business outcomes: Analyze the organization’s operating and service models. Engage with business leaders and process owners to understand their business capabilities and targeted business outcomes. Identify the impacted processes where change is required, and assess their efficiency and effectiveness. Start by looking at the value streams and the underlying end-to-end processes that drive them.

Identify areas for improvement: Look for silos, bottlenecks, redundancies, waste and inefficiencies that can be streamlined and eliminated. Improve workflows and processes by applying lean principles (eliminate waste and maximize customer value) and applying agile methodologies (an iterative approach focused on collaboration, flexibility and customer satisfaction).

Develop a roadmap for improvement: Construct project- and product-driven process and workstream improvement roadmaps. Define the scope, milestones, timelines and resources (project or fusion teams).

Identify and implement new technologies to improve process and workflows: Evaluate new technologies (AI, autonomic systems and the cloud), identify opportunities for their innovative use, and implement them in a way that maximizes their impact and minimizes business disruption.

Measure the impact of change initiatives: Devise metrics to link funding to workflow and process improvement initiatives and to customer and employee satisfaction and business outcomes. Help construct digital execution scorecards, KPI benchmarking tools, and dashboards for business and IT executives. Collect and analyze data, and communicate results to business leaders and process owners. Use the data to identify areas of future improvement, and continuously make adjustments as needed.

Related Research

Tool: Business Architecture Activities and Deliverables Close the Strategy-to-Execution Gap

Innovation Insight for Collaborative Workflow Automation

Magic Quadrant for Process Mining Tools

Magic Quadrant for Enterprise Architecture Tools

Use Value Streams to Design Service and Operating Models and Enable Application Composability

Leverage Talent

Leveraging talent entails securing, retaining, retraining and sharing the digital talent necessary to accelerate digital plans. EA leaders can help share talent.

Action 7: Rethink work models and practices to enhance how the organization leverages talent to drive business outcomes.

The Challenge

Despite corporate hiring slowing and some large technology companies reducing digital talent headcount, many organizations face key digital talent shortages in a highly competitive job market. Many organizations still struggle to hire the critical digital talent they require to accelerate the time to value of key digital initiatives. Moreover, the talent shortage is exacerbated by organizational design, the operating model, siloed behavior, talent gaps, change resistance and leadership issues.18, 19, 20, 21, 22

How Enterprise Architects Can Help

Support democratized digital delivery: Contribute EA talent (business, information, solutions, product, infrastructure and security architects) to business-led fusion and product teams. Prioritize high-impact digital initiatives where time to market is critical. Augment fusion teams with EA expertise, helping business leaders, product managers, technologists and other IT experts achieve their targeted business outcomes. Equip others, especially internal business technologists, to build business capabilities, assets and digital channels to engage customers. Empower others to participate in delivering digital solutions as part of an ecosystem, and break down psychological and bureaucratic barriers to strategic partnership.

Upgrade the EA practice: Turn the traditional EA practice into an internal management consultancy that offers a set of “services” to meet the needs of internal customers. Evolve EA’s mindset to support democratized decision making by accepting that not all business-led digital decisions need to be governed equally.

Establish a community of practice: Stand up an EA community of practice to enable fusion teams to create digital solutions faster and with higher quality, while continually improving the support provided to these teams. Support the delivery efforts of fusion teams by enabling them to operate with autonomy, self-serve and co-create with peers on shared technology platforms. Make product architecture decisions at the product and enterprise level by empowering community of practice members to exercise voting rights.

Construct a minimum viable architecture (MVA): Construct and periodically update a minimum viable architecture. Do so by working with product owners, through a community of practice, and by giving representative members of product teams voting rights and opportunities to share their challenges and feedback. Ensure the MVA eliminates technical debt, is scalable, conforms to enterprise standards, patterns and designs, and is reusable. Include key deliverables in the MVA, reference architecture components, standards, principles and product line design patterns.

Related Research

Presentation: The New EA Operating Model for Digital

Quick Answer: How Can Enterprise Architecture Support Product Management?

Quick Answer: How Must EA Governance and Assurance Change to Support Product Management?

Tool: Architecting the Democratized Organization

5 Steps to Create a Flexible Team Structure That Enables Enterprise Architecture Value Delivery

Evidence

1 Leadership Vision for 2023: Enterprise Architecture

2 Hype Cycle for Enterprise Architecture, 2022

3 Hype Cycle for Enterprise Architecture, 2022

4 9 Winning Actions to Take as Recession Threatens

5 Top Strategic Technology Trends for 2022: Total Experience

6 Achieve Best-in-Class CX Wins Through Total Experience

7 What Is Artificial Intelligence? Ignore the Hype; Here’s Where to Start

8 Hype Cycle for Artificial Intelligence, 2022

9 Applying AI — A Framework for the Enterprise

10 OKRs, KPIs and ODMs: How They’re Different and When to Use Them

11 How Enterprise Architects Use OKRs to Deliver Business Outcomes

12 2022 Gartner CEO and Senior Business Executive Survey. This survey was conducted to examine CEO and senior business executive views on current business issues, as well as some areas of technology agenda impact. The survey was conducted from July 2021 through December 2021, with questions about the period from 2021 through 2023. One-quarter of the survey sample was collected in July and August 2021, and three-quarters was collected in October through December 2021. In total, 410 actively employed CEOs and other senior executive business leaders qualified and participated. The research was collected via 382 online surveys and 28 telephone interviews.

The sample mix by role was CEOs (n = 253); CFOs (n = 88); COOs or other C-level executives (n = 19); and chairs, presidents or board directors (n = 50). The sample mix by location was North America (n = 176), Europe (n = 97), Asia/Pacific (n = 86), Latin America (n = 40), the Middle East (n = 4) and South Africa (n = 7). The sample mix by size was $50 million to less than $250 million (n = 58), $250 million to less than $1 billion (n = 81), $1 billion to less than $10 billion (n = 212), and $10 billion or more (n = 59).

13 The 2022 Gartner View From the Board of Directors Survey was conducted to understand how boards of directors (BoDs) will address the risk from economic and political volatility and a multipolar world, and their intent to convert digital acceleration to digital momentum. The survey also helps understand the impact of the key societal issues that took center-stage during the pandemic on BoDs’ strategy and investment approaches. The survey was conducted online from May through June 2021 among 273 respondents from the U.S., Europe and Asia/Pacific.

Companies were screened to be midsize, large or global enterprises. Respondents were required to be a board director or a member of a corporate BoD. If respondents served on multiple boards, they answered for the largest company, defined by its annual revenue, for which they were a board member.

14 Align Your Cloud Strategy With the Organizational Strategic Plans

15 The Cloud Strategy Cookbook, 2023

16 2022 Gartner CEO and Senior Business Executive Survey.

17 The 2022 Gartner View From the Board of Directors Survey.

18 2022 Gartner Overcoming the Barriers to Digital Execution Survey. This survey was conducted online from 1 March through 14 March 2022 to understand how to overcome barriers to digital execution. In total, 96 CIOs and IT and business leaders who were members of Gartner’s Research Circle, a Gartner-managed panel, participated. Members from North America (n = 43), EMEA (n = 35), Asia/Pacific (n = 11) and Latin America (n = 7) responded to the survey.

19 The 2022 Gartner Technology-Related Change and Fatigue Survey was conducted online from 5 through 18 July 2022 to identify the most prevalent types of IT- or technology-related change, and to understand how enterprises are approaching them successfully. The survey also focused on identifying the main symptoms and impacts of employee change fatigue and how enterprises are addressing them. The following Gartner-managed panel members participated: 56 CIO Research Circle members, 42 ITL and Business Leaders Research Circle members, and eight CFO and Senior Finance Leaders Research Circle members. Members from North America (n = 49), EMEA (n = 39), Asia/Pacific (n = 12) and Latin America (n = 6) responded to the survey.

20 The 2022 Gartner Borderless Tech Workforce Survey was conducted from May through June 2022 to understand organizations’ willingness to pursue a borderless tech workforce, their plans and adoption of a borderless workforce, major inhibitors, and critical success factors.

In total, 239 respondents were interviewed in North America (n = 127), Europe (n = 73) and Asia/Pacific (n = 39). The respondents came from four major industries — manufacturing (n = 42), retail (n = 41), high tech (n = 40), and banking and financial services (n = 32) — and the remaining sample was distributed among other industries. About 144 representing organizations were from large enterprises (with annual revenue of $500 million to less than $10 billion), while 31 were from global enterprises (over $10 billion), and the remaining 64 were from midsize enterprises ($10 million to less than $500 million). Qualified participants included C-level executives (n = 214) and executives who were one layer below (n = 25); 144 of them lead the decision making for tech talent, and the remaining 95 were part of the decision-making team.

21 2022 Gartner Barriers to Continuous Strategy Execution Survey. This survey was conducted online from 14 June through 8 July 2022 to test the impact of adaptive strategy execution on business performance. In total, 292 business leaders who were responsible for enterprise business strategy or enterprise IT strategy qualified. Respondents from North America (n = 131), Europe (n = 80), APAC (n = 50) and Latin America (n = 31) responded to the survey.

22 2021 Gartner Technology Skills Outside of IT Survey. This survey was conducted via an online platform from November through December 2021 among over 3,000 employees across functions, levels, industries and geographies. The survey was designed to understand the role that CIOs should play to support employees who produced analytic or technology capabilities and reported to a business area outside of IT.

Disclaimer: Results of these surveys do not represent global findings or the market as a whole, but reflect the sentiments of the respondents and companies surveyed.

Acronym Key and Glossary Terms

Note 1: Four Possible Economic Scenarios

Roaring back to growth: A situation where investors expect the economy to come roaring back. Accompanied by a strong increase in production of goods and services.

Stuck in time and great stagflation: Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation.

Softly landing and a slow repriming of the pump: A soft landing is achieved when the central bank manipulates monetary policy to prevent the economy from overheating, without creating a severe downturn, by increasing interest rates. Repriming of the pump in economic terms refers to the central bank stimulating growth, during an economic downturn, by increasing money supply through lowering interest rates and other open market operations. Lower interest rates encourage businesses to invest and spend, thereby stimulating growth.

Financial crisis: This is a period where financial institutions, markets, companies and consumers experience severe economic difficulty simultaneously. Typically accompanied by steep declines in asset values, coupled with liquidity issues, leading to a freezing up of the financial system in whole or part.

Source : https://www.gartner.com